What We Learned from Big Tech’s Earnings Q1 2023 (Thinks Out Loud Episode 373)

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | Amazon Music | Youtube Music | RSS

It’s time once again to take a look at the AGFAM’s earnings — Big Tech’s earnings — and see what we can learn from them. Is is that layoffs are the right way to run your business? Is it that digital is dying? Is it that the sky is falling and the economy is doomed? Nope, nope, and nope. None of those things.

What we learned from Big Tech’s most recent earnings is that digital continues to grow. We learned that “digital spend as a percentage of GDP is only going to increase." We learned that great technology only matters if you can back it up with great products. We learned that there’s plenty of uncertainty in the market, but plenty of reason for optimism as well. And, we learned that in uncertain times, little matters more than leadership.

Who’s doing a good job? Who’s struggling? And what does Big Tech’s earnings mean for your business? That’s what this episode of Thinks Out Loud is all about.

Want to learn more? Then give a listen, review the transcript, and check out all of today’s show notes. Enjoy!

What We Learned from Big Tech’s Earnings Q1 2023 (Thinks Out Loud Episode 373) — Headlines and Show Notes

Show Notes and Links

- The Sky is Falling for Digital… or Is It? Big Tech’s Earnings Q2 2022 (Thinks Out Loud Episode 357)

- Alphabet Investor Relations – Investor Relations – Alphabet

- Alphabet (GOOGL) Q4 2022 Earnings Call Transcript | The Motley Fool

- https://abc.xyz/investor/static/pdf/2022Q4_alphabet_earnings_release.pdf?cache=9de1a6b

- https://abc.xyz/investor/static/pdf/20230203_alphabet_10K.pdf?cache=5ae4398

- Microsoft (MSFT) Q2 2023 Earnings Call Transcript | The Motley Fool

- FY23 Q2 – Press Releases – Investor Relations – Microsoft

- SlidesFY23Q2.pptx

- Amazon, Google, Facebook, Apple and Microsoft Have a Secret Plan Right Now. Here’s Why You Should Care (Thinks Out Loud Episode 286)

- Microsoft Bing – Wikipedia

- AI-powered Bing Chat loses its mind when fed Ars Technica article | Ars Technica

- Amazon.com, Inc. – Quarterly results

- https://s2.q4cdn.com/299287126/files/doc_financials/2022/q4/Webslides_Q422_Final.pdf

- https://s2.q4cdn.com/299287126/files/doc_financials/2022/q4/Q4-2022-Amazon-Earnings-Release.pdf

- Amazon.com (AMZN) Q4 2022 Earnings Call Transcript | The Motley Fool

- Meta – Meta Reports Fourth Quarter and Full Year 2022 Results

- Meta Platforms, Inc. (NASDAQ:META) Q4 2022 Earnings Call Transcript – Insider Monkey

- (99+) Post | LinkedIn

- (99+) Post | Feed | LinkedIn

- Four Concepts for Hotel Marketers Dealing With Uncertainty This Year | By

- Doing Digital in the Weirdest Economy Ever (Thinks Out Loud Episode 355)

- Apple (AAPL) Q1 2023 Earnings Call Transcript | The Motley Fool

- Apple reports first quarter results – Apple

- Big Trends: The Early Innings of AI in Marketing (Thinks Out Loud Episode 374)

Free Downloads

We have some free downloads for you to help you navigate the current situation, which you can find right here:

- A Modern Content Marketing Checklist. Want to ensure that each piece of content works for your business? Download our latest checklist to help put your content marketing to work for you.

- A Brief Introduction to Thinks Out Loud. As a bonus, we’ve also included this PDF document that highlights some of our core episodes to help you dig into what the show is about. We think it will help you capture the show’s essence while you’re working your way through the 300-plus episodes published so far. Download it here.

- Digital & E-commerce Maturity Matrix. As a bonus, here’s a PDF that can help you assess your company’s digital maturity. You can use this to better understand where your company excels and where its opportunities lie. And, of course, we’re here to help if you need it. The Digital & E-commerce Maturity Matrix rates your company’s effectiveness — Ad Hoc, Aware, Striving, Driving — in 6 key areas in digital today, including:

- Customer Focus

- Strategy

- Technology

- Operations

- Culture

- Data

Subscribe to Thinks Out Loud

Contact information for the podcast: podcast@timpeter.com

Past Insights from Tim Peter Thinks

Technical Details for Thinks Out Loud

Recorded using a Heil PR-40 Dynamic Studio Recording Mic and a Focusrite Scarlett 4i4 (3rd Gen) USB Audio Interface

into Logic Pro X

for the Mac.

Running time: 31m 16s

You can subscribe to Thinks Out Loud in iTunes, the Google Play Store, via our dedicated podcast RSS feed (or sign up for our free newsletter). You can also download/listen to the podcast here on Thinks using the player at the top of this page.

Transcript: What We Learned from Big Tech’s Earnings Q1 2023

Well, hello again everyone, and welcome back to Thinks Out Loud, your source for all the digital expertise your business needs. My name is Tim Peter. This is episode 373 of the Big Show. And thank you so much for tuning in. I think we have a really, really cool show for you today.

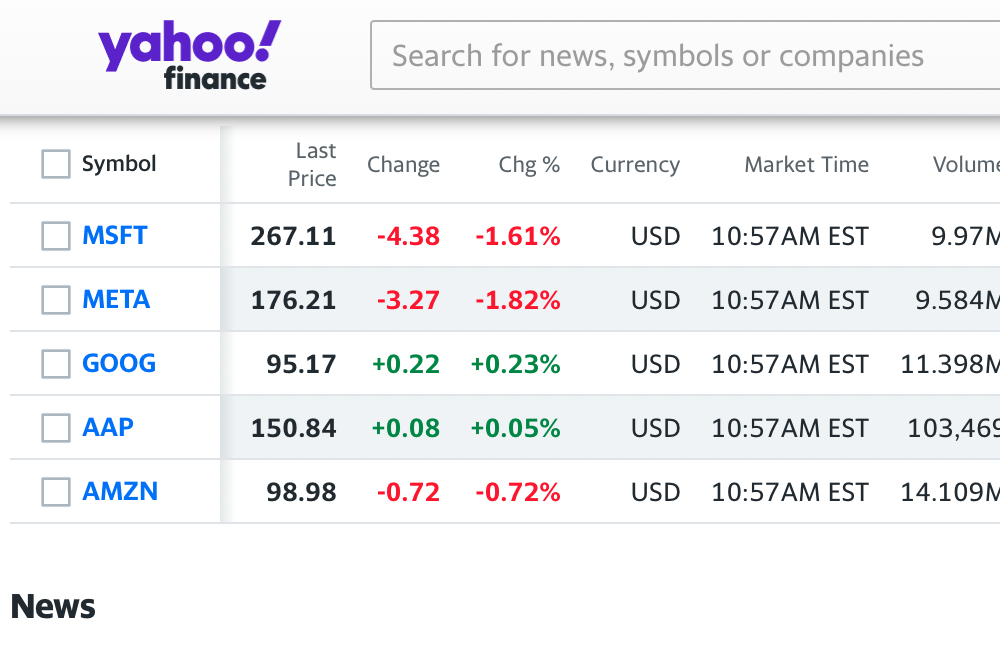

This is the episode that I do once a quarter where I look at the earnings from the various Big Tech players — Apple, Google, Facebook, Amazon, Microsoft — and try to get a sense of any bigger trends might exist based on what they’re telling us. I find it really valuable to look at these companies who are shaping the digital economy to get a better sense of what it says about the broader digital economy, what they say about the broader digital economy. And I want to get one big topic out of the way first.

The Tech Layoffs Are a Distraction For Big Tech and For You

Obviously the story that everybody is talking about are the layoffs that each of these companies has gone through. I don’t want to spend a lot of time on this. I feel so much, I feel so sympathetic for the people who were impacted by these layoffs. It’s not great. I don’t want anything I’m about to say sound flip about this. It genuinely sucks to be laid off. It genuinely sucks for the people Big Tech laid off, that the AGFAM laid off. The story also is probably a distraction from the underlying reality of what’s going on. Overall unemployment is at a record low. Mark Goldwein on Twitter was talking about we added half a million jobs in January, and unemployment is at a modern record, low record low of 3.4%. That’s crazy.

This Is About Efficient Growth

Also, almost all of these companies made ridiculous amounts of profit in real dollar terms in their most recent earnings. Their year on year profits declined in most cases, but generally speaking, they’re making money. They’re making a ton of money. They’ve said some of these layoffs are a consequence of over-investing in labor during the pandemic, getting ahead of themselves, getting more people on board than the demand would continue to support, and now needing to show Wall Street that they’ve got costs under control now that growth has slowed to more typical long-term levels. For years, these companies have been able to grow without worrying about how efficiently they achieved that growth. They clearly now feel it’s necessary to tell an efficiency story to Wall Street. Mark Zuckerberg and his team in their earnings call used the term "efficiency" at least 40 times.

So it feels like they all quote-unquote "got the memo" and have to tell a story about what’s going on here that makes Wall Street happy.

The AGFAM Continues to Grow in Real Terms

Despite the layoffs, as Scott Galloway pointed out in his newsletter and on LinkedIn the other day, the number of layoffs, the actual real percentage terms are a small percentage of their total headcount growth over the last few years. In other words, they still have far more employees now than just a couple of years ago. They are absolutely investing in their long-term growth and only cutting where they feel it’s necessary, where those prior investments don’t support their long-term strategies.

I talked about this during the pandemic in an episode where I talked about why the AGFAM has a secret plan. Right now we’re kind of seeing that except it’s not so secret. They’re investing in the areas that they think will have long-term growth and gross, and making cuts where they feel they can get away with it and tell a good story to Wall Street.

Regaining Leverage with Labor

There’s also almost certainly a degree of management trying to regain leverage they gave up over the years with all the perks that they’ve long provided.

Work from home has been one of those perks. Things like free meals and dry cleaning and massages and game rooms in the office are other examples. Labor is always one of the biggest costs for just about any company. And for the last two year, you know, year or two, labor has had pretty significant advantage compared to the historical norms. I’m not entirely surprised to see the pendulum swinging back some, regardless of whether or not I agree with it.

So I think that you don’t want to read too much into the layoffs. Again, it sucks for those people affected. It sucks for the people impact. And I am going to come back to layoffs one more time at the end in that I think it’s probably not a good idea, but I’ve already said more about the topic than I intended to. So I’m gonna move on for now.

Microsoft and Google are the Big Story

The other thing that I’m going to do this time when looking at people’s earnings is I’m going to focus mostly on Microsoft and Google. I will hit a couple of highlights from the other members of the AGFAM, from Apple, from Facebook, from Amazon. But Google and Microsoft’s earnings highlight the clearest examples of the lessons everyone’s earnings showed us. And there’s some really interesting things here.

Microsoft: Digital Spend as a Percentage of GDP is Only Going to Increase

You know, one of the biggest things, I’m gonna start with Microsoft. And one of the biggest things, and I love that Satya Nadella often gives quotes I can use for episode titles. Satya Nadella said, "digital spend as a percentage of GDP is only going to increase." He said, "we’re still in the early innings when it comes to long-term cloud opportunity." Those are both huge. You know, digital continues to grow, digital continues to take a larger share of GDP. When we think about its overall impact on GDP, it’s still, you know, maybe 50% tops, if you squint and tilt your head funny. So there’s lots and lots and lots of room to grow.

The other big players, you know, Meta/Facebook, their "Family of Apps" with billions of users, continues to grow. They have almost 4 billion users across Facebook, Instagram, and WhatsApp. And they still saw growth in the usage of those apps. Slower growth, smaller growth, you know, single digit growth, but the growth is there. And remember, this is the company that most people feel is struggling, most of all, and yet they’re still seeing growth in their apps.

Amazon talked in their earnings about international e-commerce growth. This is a big deal. We continue to see digital, take a bigger share of the economy, and we’re going to continue to see that for some time to come.

The Future is Bright. No. Really.

Another thing that really impressed me during Microsoft’s earnings is that their long-term forecast is relentlessly positive. Satya Nadella I think, is a really, really smart leader. He’s brilliant and seems to be the right leader for the moment; I’m going to talk in a minute about why leadership matters in uncertain times.

What I do want to say is Satya Nadella does seem to have a clear vision and a clear message, not just for Wall Street. And not just for his customers. But also for the people who work for the company about a long-term positive framing of the world. This idea that "digital spend as a percentage of GDP only going to increase" speaks to a positive vision that I think is very attractive for employees, for customers, for Wall Street, for all of their stakeholders.

That really resonates with me. I don’t think it’s foolishly optimistic. Their business is growing, their business is doing spectacularly well, and while they did have some layoffs, they were framed very much from the position of, "here’s the places that we know we need to invest and get better. Here’s the places where they’re not as core to our business right now." And that seems like a smart framing.

Cloud Offers Clues

You know, if you look at Microsoft, they’re much more profitable in cloud than Google is. They’re doing a really, really good job in terms of making cloud an attractive product to their customers. I suspect the Google’s problem is mostly startup costs. Microsoft has had enterprise sales teams and enterprise sales channels for decades.

It looks pretty clear that Google is still learning how to do this. That’s a real illustration of why it’s hard for companies to move outside their core competency. It’s not like Google is staffed by a bunch of morons. It’s that adding skilled people, training them on your products, building connections with potential customers and convincing them to move away from the status quo is hard, especially when the status quo is effective or entrenched.

Microsoft has years, decades, of experience in the enterprise, decades of relationships with leaders of technology groups within the enterprise. And Google is having to come in and say "Everything you’ve done in the past no longer makes sense. You need to move to something different." And Microsoft is saying, "Keep working with us. We’ve got your back. We’ve been doing this for a long time. You know, it’s a really simple transition."

This actually works against Microsoft in another area that I’ll talk about in a moment. But Microsoft clearly has a vision and clearly has expertise here, and clearly has the pieces in place to make a profitable business in a way that Google is still learning how do to do.

AI as a Product (AIAAS), Not Just a Technology

Microsoft also seems to have a great plan to incorporate AI capabilities into their cloud. AI was everywhere in the earnings call. I’ve been talking about AI, generative AI, ChatGPT, things like that a lot in the last few weeks. And clearly Wall Street has gotten the message because there were a lot of questions about these kinds of capabilities in all of the earnings calls.

Facebook talked about how much they’re going to be investing in AI. Amazon talked about it, apple talked about it. Google definitely talked about it, which again, I’ll get to in a moment.

Microsoft has a really clear story here and a clear plan that they’re able to. This is a quote from Satya Nadella. He said "Microsoft 365," for those of us who you know, come at Microsoft for a longer period, that’s what we’ve traditionally called Office. So he said, "Microsoft 365 is rapidly evolving into an AI first platform that enables every individual to amplify their creativity and productivity."

Again, that echoes something I’ve been saying that AI won’t steal your job, but smart people who use AI will. He’s saying out loud, they really see this as an enabling tool to amplify creativity, to amplify productivity.

I think that’s right. Satya Nadella also referred to GitHub Copilot — their technology that aids developers with coding — as quote "the most at scale, large language model based product out there in the marketplace today." Now, Google would surely argue its artificial intelligence bidding systems in Google Ads takes that honor.

Still, the fact that Microsoft can even make an argument at all. Is incredibly impressive. They’re doing something really remarkable here and it shows their business is doing really well.

Google Might Not Lose, But They’re Lost

Now, I want to contrast that with Google, not because Google isn’t doing well, but because their message is a little off.

You know, they had 13.6 billion dollars in earnings for the fourth quarter, almost 60 billion dollars in earnings for the year. Both of those are down from 2021. So, yeah, Wall Street hates that. They didn’t "grow." Right. Quote-unquote. At the risk of sounding naive, I’d love to have the problem of only making 60 billion dollars in profit in a year. That’s fantastic.

What we have to realize though, is that Google made 43 billion dollars of its $76 billion in revenue from search, about 57% of the total. They made $67 billion of that $76 billion in revenue from advertising. Overall, that’s 88% of the total. And more than a hundred percent of their total profits came from advertising.

Everything else they do — Cloud, Other bets, all of that — all lost money or all lost pretty substantial amounts of money. Google is still very much in the ad business. This is actually to your advantage, and is something I’m going to talk about in a moment. Any declines Google sees — and they saw declines in pretty much every advertising segment of its business — is going to hurt them.

Google’s Cloud Clues…

And this is where I want to talk about Cloud for a minute. Revenues for them went up in terms of Cloud, but it’s clearly costing them a fair bit of money to earn that revenue. It’s a less profitable business overall for them. It’s also not predictable. Google, Amazon, and Microsoft at all talked about how allowing customers to flex costs with demand, a clear selling point of Cloud plant computing, shifts the cost uncertainty from the company using cloud providers to the cloud providers themselves.

When I ran websites for large companies, we had to budget for servers and data centers and traffic because those costs were on us. If traffic declined, we were still contractually obligated. We still owned the servers. We still paid for the bandwidth. So if your servers are provided by cloud platforms as they are now, for many people, you can shut off compute cycles as demand falls, which reduces your cost and also reduces the cloud provider’s revenue. Good for you, bad for them, at least from Wall Street’s point of view.

That’s part of Google’s problem.

Amazon Scares Google

Another part of their problem came from a quote that I heard from Phillip Shindler during the earnings call. He said, quote, "We are on a multi-year mission to make Google a core part of shopping journeys for consumers and an available place for merchants to connect with users."

They clearly see Amazon as one of the biggest threats to their business. Amazon likely feels similar. Which is one reason why I think Amazon needs to get into the consumer facing search engine business using Alexa on the web and mobile, not just on its own devices. What I also will say is Amazon is gonna struggle there if they do, and here’s why. And this is sort of the big summary that I took away from a lot of this.

Google Can Lose Even if Microsoft or Amazon Don’t "Win"

As I’ve talked about the last couple of weeks, Google has fewer paths to monetize their investments in artificial intelligence than Microsoft does, than Amazon does, than Facebook does. Because Google depends so heavily on ads they can lose even if Microsoft or Amazon doesn’t win in a big way.

I want to be clear. I’m not predicting that will happen. I think Google is likely to continue to have better search results, but if they fail, this is how they’ll fail.

How Can Google Win?

So let’s talk about why I think Google will win. I think Google will continue to have a better product experience, so, search results. Which will lead to more consumer use, which will attract more advertisers, which will continue to drive revenues and profits for Google and will provide them more data to make their system even smarter, which will lead to better search results, which will lead to more consumer use, which will lead to… you see what I’m saying here?

It becomes a flywheel. The same basic playbook is true for YouTube and the Google Network partners as well, which together, you know, account for the vast majority of their ad revenue and, obviously, of their profits. Google tends to have a better experience. Their work on Google Lens and multimodal search, to give a couple of examples, are brilliant.

I also suspect that ChatGPT’s novelty will wear off for most use cases pretty soon, for most general use cases pretty soon. You know, I think when we talk about how it’s used in something like GitHub Copilot, or how it might be used in Office, or how it might be used in Outlook/email, those could be really cool. I also think that Bing isn’t where it’s going to win.

I think that Google will still provide a better product experience, a better user experience, and will continue to win market share or keep its market share on search and YouTube. Google frequently refers to search as quote "the utility for all of us." I think that’s still true and I think it’s will remain so for at least a couple of years.

"Technology" is Not the Same Thing as "Product"

Remember a couple of minutes ago when I talked about why Google struggles to be as profitable in cloud as Microsoft. As I said, it’s not that Google’s team consists of morons when we’re talking about search Bing’s team are not morons. It’s that it’s tough to dislodge established customer behaviors.

Just as I talked about in the enterprise. Consumers really are comfortable with. And there’s a huge difference between having technology and having a good product. There’s a story today that the new Bing, the ChatGPT version of Bing might be losing its mind. It’s giving some truly strange answers, getting defensive in response to questions that it’s being asked.

All of this is because Microsoft has the same problem with Bing that Google has with cloud. They’re trying to win in a space that they’ve never won in before. They’re still learning how to do this, and in theory, Bing/Microsoft has an advantage here that Google doesn’t. They’ve been doing this for decades.

Bing has been around since 2009, and it’s built on MSN Search and other tools that date back a decade or more before that. They’ve got 20-plus years of doing this. And if Microsoft had the right answer to solve for search, they probably would have found it already. I don’t want to say that they couldn’t win by incorporating ChatGPT like functionality. I’m saying that history isn’t on their side. Ancient history or current.

If Google loses, it will be because they can’t monetize search as well. Remember, search alone is roughly 57% of all their revenues and an outsized share of their profits. Declines in revenues from search could be damaging, if not outright, deadly to the company.

I just wouldn’t bet on it based on what we continue to see.

Big Themes from Big Tech’s Earnings

Now, I do think there are some big themes that emerged from all of these discussions.

- Digital will continue to grow. The first is digital is going to grow. Digital spend as a percentage of GDP is only going to increase sake. Satya Nadella told us that and I think he’s right.

- AI will play a bigger role over time. We also know that AI increasingly is a big part of that.

- Uncertainty is this year’s watchword. We also know that there’s going to be uncertainty in the marketplace for the foreseeable future. In fact, I’d argue that uncertain times are simply a fact of life today. In past episodes, I’ve talked about doing digital in the weirdest economy ever. I wrote a recent post for Hospitality Net around how to compete in uncertain times. It was targeted at hotels, but the same basic premise holds for any business. I’d recommend checking those out. I will of course link to them in the show notes. Some of that uncertainty may work to your advantage.

- There’s value to be had in your marketing spend. The cost to market your brand digitally might be a bit lower at the moment than they have been. Everyone selling ads is seeing their revenue per ad, whether on an impression or click basis, decline. Companies that are more worried about the economy are pulling back their advertising. Some we know we’ve seen for years that pulling back on your marketing during downtimes hurts your business in the longer term. Again, I will link to this in the show notes. As a result, this might be an opportunity for you to gain more value for your marketing dollar, for you to get more mind share and market share while your competitors are sitting on the sidelines.

- Content is (still) king. We also learned that content is still king. Phillip Schindler from Google said during their earnings call quote, "It all starts with a creator ecosystem." Google added NFL’s Sunday ticket to YouTube. Apple added Major League Soccer. They need content to attract attention, which allows them to attract advertisers. You need content to attract attention to grow your business. You know, I, I have recently talked, I’ve regularly talked about my friend Mark Schaefer’s concerns about content shock and how you cut through, and all of those apply here, but you don’t win by not talking to your customers, nor by not answering their questions. Content is still king. It continues to play a key role.

- Video and UGC take a larger role. The other thing that I saw in what everybody’s talking about is how video and user generated content must make up an increasing share of your content. No content strategy can be considered complete if you ignore these fundamental elements of content.

- When in doubt, stick to your knitting. Of course, another big theme is that it’s tough to break into new markets. It’s not impossible, but it’s not easy. There’s a reason why in down markets companies tend to quote unquote "stick to their knitting," focusing on the things that made them successful in the first place. Sure pivots exist. Shifting to an entirely new business with greater growth opportunities exist. Startups and other companies do it regularly. Just remember that those pivots come at the expense of what you used to do. Companies pivot because what they were doing stopped working or never worked at all. You should pivot because it’s what your customers not want, not because it’s what others are doing.

- Leadership matters. And on that note, leadership matters. I said this a moment ago, I’m impressed by Satya Nadella. He’s got a vision of where his company is going and where his company is growing. There is some evidence that he may be a better CEO at this present moment than Sundar Pacha is. He might be doing a better job. We’ll see how that plays out in the longer term.

- Layoffs are a distraction in every sense. And speaking of the longer term, I started with the layoffs, I’ll close with the layoffs. You know, a lot of times in the longer term, they’re not the best idea. Amy Hood, Microsoft’s CFO said, during their earnings call, "we take decisions like the one we had to make to get our cost structure more in line with revenue just incredibly seriously, because we have lots of very talented people who are impacted by that." She’s right. Layoffs, hurt, morale. They are a distraction. Obviously you do what you’ve got to do to keep the doors open. If you are struggling and the only thing you can do is cut, that’s understandable. I also think that most of big tech firms will regret these moves, at least somewhat in the longer term. We’ll see how it plays out, but I really do suspect that this is something they will regret sooner rather than.

For me though, the big lesson remains that digital continues to grow. There is lots of upside, lots of opportunity, lots of places for you to win, and the best part is you don’t have to generate billions of dollars in revenue or profits every quarter to keep Wall Street happy. If you keep your customers happy, you’re going to do well no matter what.

Show Closing and Credits

Now looking at the clock on the wall, we are out of time for this week. I want to remind you that you can find the show notes for today’s episode, as well as an archive of all past episodes by going to timpeter.com/podcasts. Again, that’s tim peter.com/podcasts. Just look for episode 370.

Subscribe to Thinks Out Loud

Don’t forget that you can click on the subscribe link in any of the episodes you find there to have Thinks Out Loud delivered to your favorite podcatcher every single week. You can also find Thinks Out Loud on Apple Podcasts, Google Podcasts, Stitcher Radio, Spotify, Overcast, anywhere fine podcasts are found.

Leave a Review for Thinks Out Loud

While you’re there, I would also very much appreciate it if you could provide a positive rating or review for the show. Ratings and reviews help new listeners find the podcast. Ratings and reviews help new listeners understand what the show is all about. They help get the word out. They help grow our community and it means the world to me.

I really appreciate you helping to make Thinks Out Loud a better place for everyone involved, and thank you so much for that.

Thinks Out Loud on Social Media

You can also find Thinks Out Loud on LinkedIn by going to linkedin.com/TimPeterAssociates. You can find me on Twitter using the Twitter handle @TCPeter. And as always, you can email me at podcast@timpeter.com. Again, that’s podcast@timpeter.com.

Show Outro

Finally, I want to say one last time how much I appreciate you tuning into the show every single week. I wouldn’t do this show without you. I don’t do this to hear myself talk. I do this so that we can have a conversation and build this community.

It means the world to me when you listen and you comment and you send emails and you reach out to me on social and we keep the dialogue going, so please keep the emails coming. Keep pinging me on LinkedIn. Keep pinging me on Twitter. I just love chatting with y’all about this stuff all the time.

So with all that said, I hope you have a fantastic rest of this week. I hope you have a wonderful weekend. And I will look forward to speaking with you here on Thinks Out Loud next time. Until then, please be well, be safe, and as always, take care everybody.

This Post Has 0 Comments