Amazon, Google, Facebook, Apple and Microsoft Have a Secret Plan Right Now. Here’s Why You Should Care (Thinks Out Loud Episode 286)

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | Amazon Music | Youtube Music | RSS

Amazon, Google, and Facebook Have a Secret Plan Right Now. Here’s Why You Should Care (Thinks Out Loud Episode 286) — Headlines and Show Notes

OK, let’s be fair. The plans that Amazon, Google, Facebook, Apple, and Microsoft have aren’t really a secret. But it’s clear that these digital giants (AGFAM as I have long called them, or the Frightful Five if you prefer) are doing something very different from most businesses during the COVID-19 situation. Where most businesses are pulling back investment, cutting costs, and sticking to survival mode, the Frightful Five are investing — heavily — in the future. And not just a future. Their future. The future where they control everything. They’re buying and building and busting their butts to gain even more market dominance when the economy comes back around. And that’s a huge problem for everyone else who isn’t doing those things.

This episode of Thinks Out Loud takes a look at their secret plan to extend their dominance and offers some tips on where you should look to make this challenge an opportunity for your business too.

Want to learn more? Here are the show notes for you.

Relevant Links — Amazon, Google, and Facebook Have a Secret Plan Right Now. Here’s Why You Should Care (Thinks Out Loud Episode 286)

- Amazon.com, Inc. (AMZN) Q1 2020 Results – Earnings Call Transcript | Seeking Alpha

- Facebook Inc (FB) Q1 2020 Earnings Call Transcript

- Post-Earning, Which Is Better: Alphabet or Facebook?

- https://abc.xyz/investor/static/pdf/2020_Q1_Earnings_Transcript.pdf?cache=712d537

- https://abc.xyz/investor/static/pdf/20200429_alphabet_10Q.pdf?cache=1a4ecd7

- Facebook – Facebook Reports First Quarter 2020 Results

- Exclusive: Mary Meeker’s coronavirus trends report – Axios

- Why Google is the Beast That Scares Your Industry’s 800-lb. Gorilla (Thinks Out Loud Episode 238)

- Hey Loretta, Remind Me That Google’s Got Troubles (Thinks Out Loud Episode 273)

- How the virus could boomerang on Facebook, Google and Amazon – POLITICO

- Facebook claims its new chatbot beats Google’s as the best in the world | MIT Technology Review

- Why You Should Be Optimistic About the Future Right Now (Thinks Out Loud Episode 285)

- Pandemic-Proof Digital Trends: What You Need to Know (Thinks Out Loud Episode 284)

- Why Hotel Marketers Must Think “Backyard and Bundle” When Demand Returns

- How You Can Make Digital Do Your Heavy Lifting in Difficult Times (Thinks Out Loud Episode 283)

- We Live in the Future (Thinks Out Loud Episode 274)

- Your Big Opportunity When The Current Crisis Ends? Adults Under 40 (Thinks Out Loud Episode 280)

- Worried About a Recession Next Year? Here’s How Marketers Can Cope (Thinks Out Loud Episode 264)

- How Marketers Can Plan for the Recovery (Thinks Out Loud Episode 281)

- What the 2019 Mary Meeker Internet Trends Report Means for Digital Marketers (Thinks Out Loud Episode 248)

- Thinks Out Loud Episode 30: The Rise of AGFAM (Apple, Google, Facebook, Amazon, Microsoft) and Everywhere Shopping

- Content is King, Customer Experience is Queen (Thinks Out Loud Episode 188)

- Data is the Crown Jewels: What That Means for Marketers Today (Thinks Out Loud Episode 239)

- How To Run Your Business As If Google Didn’t Exist (Thinks Out Loud Episode 298)

- How to Build a Digital Company (Thinks Out Loud 302)

- The Rebirth of Trusted Gatekeepers (Thinks Out Loud Episode 307)

- We’re Living Through a Generational Shift to Digital (Thinks Out Loud Episode 317)

- What Do the AGFAM’s Earnings Tell You About the State of Digital in Q2? (Thinks Out Loud Episode 348)

You also might also enjoy this webinar I recently participated in with Miles Partnership that looked at "The Power of Generative AI and ChatGPT: What It Means for Tourism & Hospitality" here:

Free Downloads

We have some free downloads for you to help you navigate the current situation, which you can find right here:

- A Modern Content Marketing Checklist. Want to ensure that each piece of content works for your business? Download our latest checklist to help put your content marketing to work for you.

- Digital & E-commerce Maturity Matrix. As a bonus, here’s a PDF that can help you assess your company’s digital maturity. You can use this to better understand where your company excels and where its opportunities lie. And, of course, we’re here to help if you need it. The Digital & E-commerce Maturity Matrix rates your company’s effectiveness — Ad Hoc, Aware, Striving, Driving — in 6 key areas in digital today, including:

- Customer Focus

- Strategy

- Technology

- Operations

- Culture

- Data

Best of Thinks Out Loud

You can find our “Best of Thinks Out Loud” playlist on Spotify right here:

Subscribe to Thinks Out Loud

Contact information for the podcast: podcast@timpeter.com

Technical Details for Thinks Out Loud

Recorded using a Heil PR-40 Dynamic Studio Recording Mic and a Focusrite Scarlett 4i4 (3rd Gen) USB Audio Interface

into Logic Pro X

for the Mac.

Running time: 18m 10s

You can subscribe to Thinks Out Loud in iTunes, the Google Play Store, via our dedicated podcast RSS feed (or sign up for our free newsletter). You can also download/listen to the podcast here on Thinks using the player at the top of this page.

Transcript: Amazon, Google, Facebook, Apple and Microsoft Have a Secret Plan Right Now. Here’s Why You Should Care

[Updated: May 8, 2024]

Well hello again everyone and welcome back to Thinks Out Loud, your source for all the digital marketing expertise your business needs. My name is Tim Peter, this is episode 286 of The Big Show, and I think we have a really cool episode for you today, a really interesting episode, because there is a lot going on that’s worth talking about.

And I recognize right now for many folks who listen to the show, you know, your number one focus is how do we get to the end of the month? How do I get to the end of the next two months or the end of the quarter? Because there is a lot of problems out there. There’s a lot of challenges out there. There’s a lot of struggle out there.

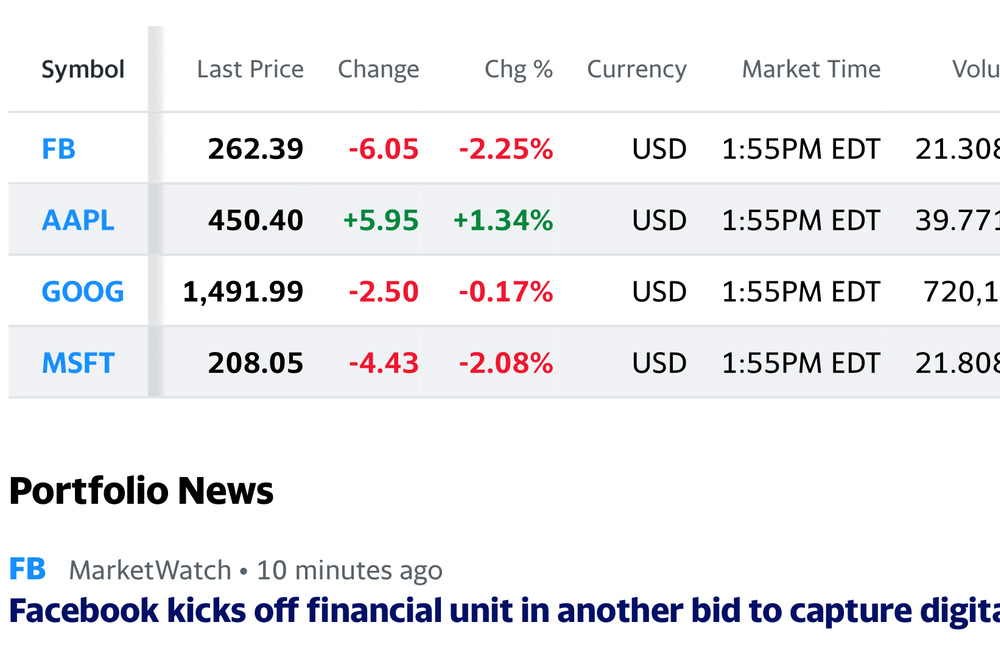

And while all of that’s true, there’s also an unbelievable trend that we all should be paying attention to. And it involves our old friends, the Frightful Five, Apple, Google, Facebook, Amazon, Microsoft, or AGFAM, as I like to call them. And yes, I know that Google is now Alphabet, but then I have to call it Ah-FAM, or Mah-Fah, or something like that. AGFAM is just easier to say, or the Frightful Five, whatever you prefer, but we’re talking about, you know, these folks who are the dominant players. And what’s interesting is while many businesses are struggling, these folks kind of aren’t.

They’ve all released their quarterly earnings within the last week or so for the first quarter. And they all acknowledged that a lot changed towards the end of the quarter, right? Anything that’s been going on with COVID-19, anything that’s been going on with the coronavirus, et cetera, and the economic, et Impacts of that really didn’t start for most businesses in the U.

S. until, you know, March. Obviously each of these companies had exposure in Asia where COVID 19 was a thing going back to December and the like. Now, obviously, they’re talking to the stock, you know, analysts here in the United States, so much of their focus for that discussion has been on the United States as well as the impacts globally.

But there was a really fascinating trend that I thought you would really want to pay attention to. And that is the fact that, while many businesses are really struggling during this period, these guys, these folks, are on the move. They are using this as an opportunity. You know, the impacts that each of them has faced have varied.

Obviously, Google and Facebook make far, far larger, larger proportions of their revenue and their profits from advertising, so they have faced a more difficult end of the first quarter and probably early month or so of the second quarter than say, Amazon, who makes a decent amount of money in advertising, or Microsoft and Apple, who do not.

But they all basically spoke about the same basic trends, and none of these are going to come as any surprise to you based on what you’ve been witnessing. You know, first and foremost, they’ve seen a huge shift, as you undoubtedly have, in people moving from, you know, in person services. to things that they can do online.

So, you know, when we’re looking at the different places where they’ve seen growth, they’re seeing growth in their cloud based businesses. They’re seeing growth in technology that supports people working virtually and things along those lines. They’re seeing growth in digital entertainment, they’re seeing growth in grocery delivery, they’re seeing growth in things like telehealth and telecommuting and teleconferencing.

So any place where they’re working in those areas, and many of them are working in a lot of those areas, They’re actually doing really great, you know, in the places where they focus on, let’s say Amazon, excuse me, let’s focus on Google and Facebook with advertising, you know, they talked about how travel and auto, which are big categories for them, have done very, very poorly, like you might expect.

And I can’t say they’re necessarily offsetting all of those changes with the revenue that they’re getting from these other areas, whether it’s other advertising categories that are in the areas like gaming and entertainment and the like, or whether it is they provide services like Google Cloud, Amazon Web Services, Microsoft Azure, et cetera, that allow them to capitalize on investment by companies who depend on those platforms.

But they are undoubtedly taking advantage of this reality. To increase the leverage that they have over the customer journey and the overall experience the customers have. And there were a couple of quotes that came up in their individual earnings calls that I thought were really, really worth paying attention to.

Facebook said, we’re seeing people who are driving toward online conversion events do well. Because they’re able to kind of bid in the auction and get those users and get those results. That was David Wenner, who’s the Chief Financial Officer. He also said, we saw relative strength in gaming technology.

And e commerce, we had quotes from people at Amazon who said beginning in early March we experienced a major surge in customer demand. Things like video conferencing, gaming, remote learning, entertainment are all seeing much higher growth and usage. Sundar Pichai at Google said ultimately we’ll see a long term acceleration of movement from businesses to digital services including increased online work, education, medicine, shopping, and entertainment.

These changes will be significant and lasting. And that’s the thing that I think is so fascinating. First, we’re seeing a fundamental change in the way customers do things and some elements of this will continue. Microsoft had the quote of the quarter from my money where they said they had seen two years worth of digital transformation in the cloud in two months.

And while many companies, many businesses are struggling right now, each of these players look at this as an opportunity. For Google, it’s kind of turned out to be a blessing in a way that they never expected. You know, I’ve said for years, I’ve criticized the company for years because they make, you know, quote unquote, all their money from advertising.

About 60 percent of all their revenues come from search alone and 22 percent more come from other advertising. So 82 percent comes from all this other stuff. Now I do say all its money in quotes because a few billion dollars out of tens of billions isn’t a significant percentage, but it is a lot of money.

They made roughly 2. 8 billion from cloud alone, and they’ve said they’re going to continue to invest in the areas where they see customers going long term. So they talk about things like AI. They talk about things like ambient computing. They talk about things like using their technology base with deep technology, deep computing, deep computational scale.

That they believe will stand the test of time. These are more or less quotes. And to quote Sundar Pichai directly, he said, Beyond that, we are actively looking at how user patterns are emerging. So, for example, e commerce is an area. And you saw us respond through this with the changes we announced on our shopping property, dot, dot, dot.

And with new leaders in place, we’re going to be making sure we work on the user experience there. They’re investing in e commerce in a big way because they recognize that’s actually what’s going to work for them. You know, another perfect example is that Amazon has invested more than 600 million in COVID related costs in Q1.

And this is a quote from David, Wenner, excuse me, Brian Olszewski, who is the CFO at Amazon, who said, we expect these costs could grow to 4 billion or more in Q2. That’s insane that they are investing that much. Another perfect example was Facebook, where David Wenner said, they made an investment in a company called Jio in India.

And David Wenner said, quote, Our strong balance sheet proved to be an important asset this quarter, allowing us to commit to a long term growth priority in India, even in the midst of a troubled global economy. Now, for anybody who’s ever seen the movie It’s a Wonderful Life, this is kind of like when Mr.

Potter bought the bank in Bedford Falls. You know, it’s great if you’re Mr. Potter. It’s great if you’re the bankers who got bought. But maybe it’s not so great if you’re the customers of the bank or the competitors to the bank, because they’re actually taking advantage of the situation to their credit, using their balance sheet, using the money that they have saved up to make sure they shut people down.

They shut out competition. Ben Thompson was talking about Amazon’s situation where they really struggled the early part of April to meet. Demand. And he said, quote, this needless to say falls in the good problem to have category. The signaled preference of consumers is that they want more Amazon than Amazon is able to deliver.

Theoretically, of course, this also leaves an opening to competitors. What is meaningful about Amazon’s intent on spending, whatever is necessary this quarter to meet the demand, is it signals the company’s intent to slam that window shut. These folks recognize. That this is a moment for them to strike.

This is a moment for them to actually win greater share. Now, I’ve talked before about how you compete with Amazon and Expedia and all these folks. And one of the ways you do is you don’t back away when times are troubled. It doesn’t mean you go head to head with them, because of course you’re not going to outspend, you know, Facebook for geo, right?

In most cases, you’re not going to spend four billion dollars and a quarter against, you know, increased demand. But what you have to do is say, where are the places we need to get leaner? And where are the places we need to be focused on how customer behavior is changing and invest in that right now? You know, one of those areas I’ve talked about is content.

You need to make sure your content works. Aaron Orendorf, who’s a great read, I will link to him on Twitter and to his website, has said, now is an unprecedented moment. Now is e commerce’s time to act. Now, I take it a little further and say, how do you make it all e commerce for your business? How do you put these trends together?

Digital transformation is something I’ve been talking about for a long time, and I’m not alone in this, but it’s something we’ve been talking about for a long time because it’s incredibly important to be ready for these moments. And if you’re not ready, it’s okay in the sense that, you know, what do they always say?

The best time to plant a tree is 10 years ago. The second best time is to plant one today. You know, Mary Meeker put out a great report — she typically does a report every year. I talk about it every year on the show. But she put out a great report about how we’re kind of moving in an e commerce direction.

Digital transformation is accelerating. This is from Mary Meeker. She said, On a relative basis, when we look back on business trends in the spring of 2020, it is likely that businesses doing the best tended to have, and I’m just going to hit these real quick. One, cloud based business. Two, products always in demand, but especially so in uncertain times.

Three, easily discoverable online presence that seamlessly helps consumers. Four efficient ways to distribute product to consumers in limited contact ways. Five, products that make business more digitally efficient. Six, broad or emerging social media presence. Content is king. Customer experience is queen.

Data is the crown jewels is the thing I’ve talked about before. And think about that. That’s what we’re talking about here. So she gives some great examples about restaurants shifting from seeding to curbside pickup. Or stores adapting to sell products on information only websites. It’s how you take advantage of this opportunity and using whatever capital you have available to you to say, where can we invest right now that sets us up for the longer term recovery?

We know that CEOs and CTOs are accelerating IT spend. We know that consumers need more support. So how can you help those customers and take advantage of this opportunity, too, in a way that puts you in a great position to win for the long term? Because it’s clear that the big guys are going to do it.

The thing is, if you don’t use this opportunity, Then all that’s going to be left for your customers is the big guys and that’s not the place you want to be because that, not the recession and not the economy and not the coronavirus is what’s actually going to hurt you in the long run. This is a window of opportunity.

It’s a painful one. It’s not an easy one. But this is one of those moments where you have to say what kind of company do we need to be from this day forward? And how do we set ourselves up to support our customers in those ways for the future? Because if you can do that well, then when the recovery comes, your business won’t just recover, it will thrive.

Now, looking at the clock on the wall, we are out of time for this week, but I want to remind you that you can find the show notes for today’s episode, as well as an archive of all past episodes, by going to timpeter. com slash podcast. Again, that’s timpeter. com slash podcast. Just look for episode 286. And while you’re there, you can click on the subscribe link in any of the episodes you find there to have Thinks Out Loud delivered to you every single week.

You can also subscribe to Thinks Out Loud on Apple Podcasts, Google Podcasts, Stitcher Radio, Overcast, whatever your favorite podcatcher happens to be. Just do a search for Tim Peter Thinks, Tim Peter Thinks Out Loud, or Thinks Out Loud. We should show up for any of those. While you’re there, I’d also really appreciate it if you could provide Provide us a positive rating of review.

It helps new listeners find us, helps them understand what the show is about and makes an enormous difference for the podcast overall. You can also find Thinks Out Loud on Facebook by going to facebook.com/tim Peter Associates, and you can find me on Twitter using the Twitter handle at TC Peter. Of course, you can also email me by sending an email to podcast(at)timpeter.com. Again, that’s podcast(at)timpeter.com.

I always appreciate the fact that you listen, and I know I say it every week, but I really would not do this show without you. It means a lot to me that you tune in. I hope you have a great rest of the week wherever you happen to be. I hope you have a wonderful weekend, and I’m looking forward to speaking with you here again on Thinks Out Loud next time.

Until then, especially given the current situation, please, be well, be safe, and as ever, Take care, everybody.

This Post Has 0 Comments